Introduction to Real Estate Investment in Kenya

Real estate investment in Kenya has evolved into one of the most lucrative and stable opportunities for both local and international investors. With a growing population, expanding urban centers, improved infrastructure, and increasing demand for residential and commercial spaces, Kenya offers an ideal environment for real estate growth. Whether you’re interested in buying land, developing rental properties, or investing in mixed-use developments, this guide offers comprehensive insights into real estate investment in Kenya.

Why Invest in Kenya’s Real Estate Market

✅ Growing Urbanization & Infrastructure

Major cities like Nairobi, Mombasa, Kisumu, and Nakuru are experiencing rapid growth. Developments such as the Nairobi Expressway, the Standard Gauge Railway (SGR), and new bypasses are increasing property values in their surrounding areas.

✅ High Return on Investment (ROI)

Well-located properties, especially in satellite towns like Ruiru, Juja farm, and Thika, are delivering ROI between 12% and 20% annually depending on property use and management.

✅ Government Support & Incentives

The government promotes affordable housing and public-private partnerships. There are also tax incentives for certain property developments and REITs (Real Estate Investment Trusts).

Types of Real Estate Investments in Kenya

- Residential Properties

- Apartments, townhouses, gated communities

- High demand in urban areas & satellite towns

- Commercial Properties

- Office spaces, warehouses, retail stores

- Thriving in Nairobi CBD, Westlands, and Mombasa Road

- Land Investment

- Most preferred due to appreciation and flexibility

- Prime plots available in Joska, Juja, Kamulu, and Thika

- Vacation Homes & Airbnb

- Strong in Nanyuki, Diani, Naivasha, and Maasai Mara

- Ideal for short-term rentals with tourist demand

- Mixed-Use Developments

- Combine residential, retail, and office space

- Popular in Nairobi and other upcoming cities

- Real Estate Investment Trusts (REITs)

- Passive investment with diversified property portfolio

- Regulated by Capital Markets Authority (CMA)

Best Locations to Invest in Kenya Real Estate (2025 Edition)

| Location | Investment Type | Why It’s Hot |

|---|---|---|

| Ruiru | Land, Apartments | Infrastructure, university population growth |

| Syokimau | Gated communities, plots | Near SGR, JKIA, expressway |

| Thika | Commercial, residential | Affordable land, upcoming developments |

| Naivasha | Airbnb, holiday homes | Tourism hub, near geothermal sites |

| Nairobi CBD | Commercial offices | Business center, foot traffic |

| Kitengela | Residential estates | Middle-class demand, affordable land |

| Mombasa | Beachfront, Airbnb | Tourist attraction, port access |

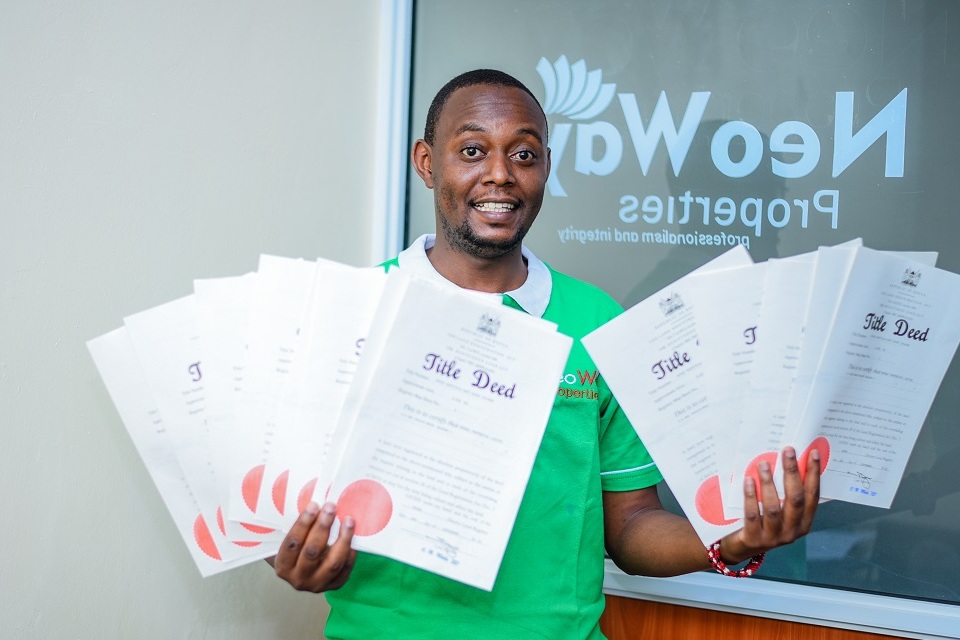

Legal Process of Buying Property in Kenya

- Conduct Due Diligence

- Verify title deed and ownership from the Ministry of Lands

- Confirm zoning laws and land use restrictions

- Use a licensed advocate for conveyancing

- Sale Agreement

- Drafted by a lawyer, includes purchase terms and payment plan

- Often requires a 10% deposit

- Land Control Board Consent (for agricultural land)

- Approval for non-citizens and foreign entities

- Transfer & Registration

- Transfer forms signed, stamp duty paid (4% for urban land, 2% for rural)

- New title issued within 30–90 days

- Pay Other Fees

- Legal fees (1.5%–2%), stamp duty, registration fees

Foreigners Investing in Kenya Real Estate

- Foreigners cannot own freehold land but can lease land for up to 99 years.

- Ideal options include apartments, commercial property, and leasehold land.

- Engage licensed real estate agents and lawyers to ensure compliance with Kenyan laws.

Key Factors to Consider Before Investing

- Market Research: Analyze current trends, demand, and rental yields

- Land Titles: Confirm property ownership and title deed validity

- Zoning Laws: Ensure property use aligns with county regulations

- Accessibility: Evaluate road networks, amenities, and security

- Water and Electricity: Confirm utility connections and availability

Taxes & Charges for Real Estate Investors in Kenya

| Charge/Tax | Rate/Amount |

|---|---|

| Stamp Duty | 2% (rural) or 4% (urban) |

| Rental Income Tax | 10% monthly on gross rental income |

| Capital Gains Tax | 15% on property sale profits |

| Land Rates | Varies by county |

| VAT on Commercial | 16% if applicable |

Top Real Estate Investment Tips for Kenya

- Buy in upcoming areas before infrastructure matures

- Invest in land with ready title deeds and accessible roads

- Use real estate agents registered by the Estate Agents Registration Board (EARB)

- Join SACCOs or investment groups (chamas) for pooled resources

- Consider building rental units for consistent cash flow

- Diversify between short-term rentals and long-term holdings

- Work with surveyors and architects to maximize land potential

Risks in Real Estate & How to Avoid Them

| Risk | How to Mitigate |

|---|---|

| Fake title deeds | Conduct official land search & work with lawyers |

| Fraudulent sellers | Use verified agents and official transactions |

| Zoning violations | Confirm with county offices |

| Delayed developments | Choose reputable developers & projects |

| Poor rental management | Hire professional property managers |

| Oversupply in saturated areas | Do thorough market analysis before purchase |

Your Path to Real Estate Wealth in Kenya

Real estate investment in Kenya remains a powerful strategy for wealth creation and financial freedom. From buying plots in fast-developing towns to investing in rental units in urban centers, opportunities abound for all types of investors. As the property market continues to grow in value and scope, staying informed, working with professionals, and making strategic decisions are the keys to success.

Whether you’re a first-time investor or an experienced property owner, Kenya’s real estate sector provides a robust platform for sustainable growth. Take the time to research, plan wisely, and secure your share of Kenya’s booming property market.