How Kenyans in the Diaspora Can Buy Land in Kenya

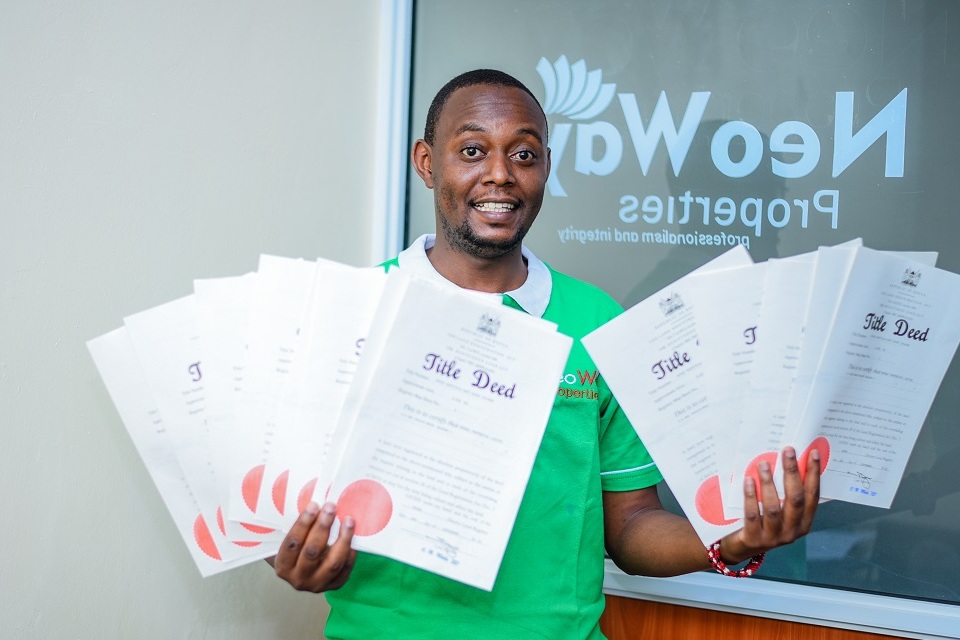

For Kenyans living abroad, owning land in Kenya is more than nostalgia — it’s a powerful way to invest, build a legacy, and diversify your wealth. Juja Farm (Kiambu) and Ruiru are two of the most promising regions for land investment: they combine strategic location, strong infrastructure growth, and increasing demand. But to do it right — especially from overseas — requires careful planning, legal diligence, and the right partners. In this comprehensive guide, you’ll learn exactly how diaspora Kenyans can safely buy land in Juja Farm and Ruiru, avoid common land-buying risks, and maximize their long-term returns. 1. Why Juja Farm and Ruiru Are Ideal for Diaspora Investors Strategic Growth Corridors Verified Growth Potential Secure Title and Legal Protection 2. Legal Steps and Due Diligence for Diaspora Buyers A. Verify Ownership B. Confirm Plot Status C. Payment Arrangements D. Documentation & POA 3. Financial Planning and Investment Strategy Payment Plans Investment Strategies 4. Mitigating Risks: Common Pitfalls and How to Avoid Them Real Estate Scams Due Diligence Failures Overpaying 5. Why Now Is the Right Time for Diaspora Investment in Juja and Ruiru 6. Practical Checklist for Diaspora Buyers Step Action 1. Research Review Neoway’s Juja Farm and Ruiru projects; request full site plans. 2. Legal Verify Hire a lawyer to do a land search and examine title deeds. 3. Financial Plan Agree on a payment plan or transfer funds securely. 4. Authorize POA Grant Power of Attorney to a verified representative if not in Kenya. 5. Inspect Visit Kenya if possible or hire a local agent to verify the plot in person. 6. Complete Legal Paperwork Sign sale agreements, transfer title, and register ownership. 7.Building a Legacy With Confidence For Kenyans in the diaspora, investing in land in Juja Farm and Ruiru presents a powerful opportunity — not just to grow wealth, but to lay a foundation for future generations. By leveraging verified, high-potential parcels, working with a trusted firm, and following legal best practices, you can make a safe and profitable investment from abroad. When done correctly, this investment isn’t just about owning a plot; it’s about creating a legacy and participating in Kenya’s real estate growth story.

5 Mistakes Kenyans Make When Buying Land

5 Mistakes Kenyans Make When Buying Land — Number 4 Is the Most Costly Buying land in Kenya can be one of the most rewarding investments, but it can also be risky if you make avoidable mistakes. Many first-time buyers, and even experienced investors, often fall into the same traps, which can lead to financial loss, legal disputes, or missed opportunities. Understanding these common errors is crucial for anyone looking to secure land that appreciates over time and is legally safe. This guide highlights the five most common mistakes Kenyans make when buying land, with practical advice on how to avoid them and make informed investment decisions. 1. Failing to Verify Land Ownership One of the biggest risks when buying land in Kenya is purchasing property with unclear or disputed ownership. Many buyers assume the seller has legitimate documents without conducting proper verification. How to Avoid This Mistake Why It Matters: Buying land without proper verification can result in legal battles, financial loss, or even eviction if the sale turns out to be fraudulent. 2. Ignoring the Location and Growth Potential Many buyers focus solely on affordability and overlook the importance of location. Cheap land in a stagnant area may not appreciate much over time, whereas moderately priced land in a high-growth zone can yield significant returns. Factors to Consider Tip: Invest in areas showing consistent infrastructure growth and rising demand, like Juja, Ruiru, Kitengela, and Kamulu. 3. Underestimating Additional Costs The price of land is just one part of the total investment. Many buyers fail to budget for associated costs, which can be substantial. Additional Costs to Plan For Why This Mistake Is Costly: Without factoring in these costs, buyers may end up underfunded and unable to complete the purchase or develop the land as planned. 4. Skipping Proper Due Diligence (The Most Costly Mistake) This is the number one mistake that causes the largest losses. Many buyers rely on trust alone or make decisions based on hearsay. This includes failing to inspect the land, verify zoning, check for pending disputes, or confirm the legitimacy of sellers. How to Conduct Due Diligence Impact: Skipping due diligence can lead to buying land with ownership disputes, illegal zoning, or restricted use, costing far more than the land itself. 5. Falling for Unrealistic Promises and Deals Some buyers are tempted by “too good to be true” offers, such as extremely cheap land in prime locations or quick-profit schemes. Scammers often target uninformed investors. Red Flags to Watch Out For Advice: Always verify the legitimacy of the seller, compare market prices, and avoid rushed decisions. Tips to Buy Land Safely and Smartly The Importance of Being Informed Land in Kenya is one of the most secure and appreciating assets, but only if you approach the market intelligently. Avoiding these mistakes ensures that your investment is legally safe, strategically located, and financially sound. Buyers who take time to verify, inspect, and plan are more likely to enjoy steady appreciation, secure ownership, and profitable development opportunities. Strategic Insights for Safe Land Buying in Kenya Investing in land is more than paying the asking price. It’s about understanding location dynamics, legal processes, development trends, and market realities. Avoiding these five common mistakes—and especially conducting proper due diligence—positions you to make smart, profitable, and safe land purchases in Kenya’s fast-growing real estate market.

How to Spot Genuine Land Sellers in Kenya

The Kenyan land market is booming, but along with rapid growth comes increased risk of scams, fraudulent sellers, and unscrupulous middlemen. Many investors and first-time buyers have lost money because they trusted the wrong seller, ignored verification, or rushed into a purchase. Knowing how to identify genuine land sellers is crucial for secure investments. This guide provides practical, data-backed tips on spotting legitimate sellers, verifying property authenticity, and avoiding the common traps in Kenya’s land market. Why Identifying Genuine Sellers Matters Land scams in Kenya happen for several reasons: Investing with a genuine seller ensures your money is safe, your property is legally secure, and your investment can appreciate without dispute. 1. Verify Title Deeds Thoroughly A genuine seller must provide a valid and verified title deed. Many scams occur when buyers accept photocopies, unofficial documents, or incomplete ownership papers. Steps to Verify Without proper verification, the property may be claimed by someone else later, causing financial and legal headaches. 2. Assess the Seller’s Reputation Legitimate sellers often have a verifiable history of successful transactions or a reputable presence in the market. Avoid sellers with little or no track record, online-only interactions, or pressure tactics. How to Check Reputation A trustworthy seller will be transparent, responsive, and professional. 3. Inspect the Land Personally Fraudulent sellers often misrepresent land size, location, or boundaries. Visiting the land personally helps confirm: Never rely solely on photos or verbal descriptions. A physical inspection prevents costly surprises. 4. Avoid Deals That Are Too Good to Be True Scammers often lure buyers with extremely low prices, promises of instant returns, or “exclusive” deals in prime locations. While affordability is important, extremely low-priced land is often a red flag. Tips If it sounds too good to be true, it probably is. 5. Work With Licensed Real Estate Professionals One of the safest ways to avoid scams is using licensed real estate agents, developers, or companies. They have verified listings, understand legal procedures, and provide guidance for safe transactions. Benefits Trusted professionals act as intermediaries, reducing the risk of fraud and ensuring smoother transactions. 6. Understand Legal Processes and Documentation Even with a verified seller, buyers must understand legal steps: Proper legal procedures safeguard your investment and confirm ownership rights. Red Flags of Fraudulent Sellers Recognizing these red flags early saves time, money, and stress. Conclusion: How to Buy Land Safely in Kenya Genuine land sellers exist, but finding them requires diligence, research, and caution. Verify ownership, inspect plots, compare market prices, avoid unrealistic deals, and work with licensed professionals. By following these steps, investors secure land that is legally safe, appreciating, and profitable over time. Investing in genuine land today ensures your property is a long-term asset and a foundation for wealth creation in Kenya’s rapidly growing market.

How Much Money You Really Need to Start Buying Land in Kenya (Most People Get This Wrong)

Many Kenyans believe buying land requires millions, but that assumption stops most people before they even begin. The truth is that land buying in Kenya has multiple entry levels, flexible payment plans, and a wide range of options depending on location, purpose, and development status. Understanding how much money you truly need can help you make informed decisions and begin your investment journey earlier than expected. This guide breaks down the actual costs involved, common misconceptions, and realistic budget categories for different types of land buyers. Why Most Kenyans Misjudge the Cost of Buying Land There is a common belief that land is only for people with large savings or extremely high income. This misconception is fueled by high land prices in Nairobi’s central areas, viral social media posts showing premium estates, and assumptions based on the most expensive properties. However, the Kenyan land market is diverse. There are affordable, mid-range, and high-end options—each with its own pricing structure. When you understand the categories, the payment options, and the additional costs involved, buying land becomes a clear and achievable goal for more people. 1. The Real Entry-Level Budget for Buying Land Entry-level land refers to affordable plots located in growing satellite towns or rural areas with upcoming development. These areas often offer the best long-term value because they appreciate as infrastructure and population expand. Average Entry Budget: KSh 150,000 – KSh 600,000 You can get land within this range in locations such as: These plots are suitable for: The key advantage is that these plots appreciate significantly once roads, water, electricity, and business activity increase. 2. Mid-Range Land Investments in High-Growth Zones Mid-range land is found in fast-growing towns with active development, expanding roads, and increasing demand from people migrating out of major cities. These plots often come with better infrastructure and more stable growth projections. Average Budget: KSh 700,000 – KSh 3 Million Areas in this category include: These regions offer: Investing in mid-range zones increases the likelihood of faster value growth due to infrastructure expansion and ongoing construction activities. 3. Premium Land Near Nairobi Metropolitan Growth Corridors Premium land sits in high-demand urban and peri-urban areas known for rapid appreciation and high-quality developments. These zones typically have schools, hospitals, shopping centers, and industrial projects driving demand. Average Budget: KSh 3 Million – KSh 15 Million Popular locations include: These plots are ideal for: Land prices in these regions rise quickly due to increased settlement and proximity to major highways and Nairobi CBD. 4. High-End Investment Zones With Exceptional Growth This category consists of towns experiencing strong commercial development and premium residential growth. They are often influenced by tourism, expatriate demand, gated communities, and lifestyle estates. Average Budget: KSh 15 Million – KSh 50 Million+ Locations include: These plots appreciate quickly because of limited availability, premium amenities, and high investment interest from both local and diaspora buyers. Hidden Costs You Must Budget For When Buying Land Many buyers assume the land price is all they need, but additional charges often determine the actual investment cost. 1. Title Processing Fees This varies based on location, but it covers documentation, transfer, and registration. 2. Legal Fees A lawyer is crucial for verification, due diligence, and contract preparation. 3. Stamp Duty Usually 2% – 4% depending on the county and land location. 4. Survey Fees Needed for subdivisions and official land measurements. 5. Valuation Fees Banks and lawyers may require valuation before completion of the transaction. 6. Site Visit or Transport Costs Part of the overall expense when viewing multiple properties. Understanding these costs helps you avoid budget surprises and plan more confidently. Flexible Payment Plans and How They Reduce the Initial Budget Many reputable real estate companies in Kenya offer: This reduces the barrier to entry by allowing buyers to secure land with lower upfront amounts. In mid-range and entry-level areas, you can often begin with: This makes it possible for salaried workers, small business owners, and even students to start building land ownership gradually. How Much You Need Based on Your Goal If you want to start with what you can afford: KSh 150,000 – KSh 600,000 is a realistic entry point. If your focus is fast appreciation: Budget KSh 700,000 – KSh 3 million in high-growth satellite towns. If you want land for building rentals or homes: Plan for KSh 3 million – KSh 15 million. If you’re going for prestige and premium growth: Budget KSh 15 million and above. What This Means for Land Buyers in Kenya Many Kenyans postpone land buying because they assume it requires millions. However, the reality is that the market is wide and flexible. Once you understand the different pricing levels, hidden costs, and payment plans, you can begin your investment journey at a much earlier stage. The biggest advantage goes to early buyers. Land appreciates consistently, and those who secure property now will enjoy higher long-term value, stronger security, and greater financial flexibility in the future.

Areas in Kenya Where Land Prices Are Rising Faster Than Salaries

Kenya’s land market has changed rapidly in the past decade. While salaries for most Kenyans have barely grown, land values in some regions are increasing at rates that far exceed income growth. This shift has created a powerful opportunity for investors who want to secure appreciating assets that can outperform inflation, employment income, and traditional savings methods. Understanding where land prices are rising the fastest helps investors position themselves early. These fast-growing regions often share common characteristics—major infrastructure upgrades, increased population movement, new commercial and industrial activity, and strong demand from buyers looking for affordable but promising alternatives to Nairobi’s high prices. Below is a detailed breakdown of the areas currently experiencing the fastest land appreciation in Kenya and why they are outperforming salary growth. 1. Juja Farm – High-Growth Investment Area Fuelled by Infrastructure Development Juja Farm has transitioned from a quiet peri-urban location into one of Kenya’s fastest-growing investment corridors. The region’s rapid land value increase is driven by several key forces: Why Juja Farm Is Growing Faster Than Salaries • Massive ongoing infrastructure upgrades Road construction and improvements have significantly increased accessibility. The connection to Thika Road, together with the ongoing tarmacking within Juja Farm, has lowered commute times and made the area attractive for both settlement and speculation. • Rising demand from Nairobi and Kiambu residents Nairobi’s expansion has pushed homebuyers and investors into more affordable satellite towns. Juja Farm offers lower entry costs while still providing proximity to major towns. • Increasing commercial activity New shops, hardware stores, educational institutions, medical facilities, and residential developments have created an economic ecosystem that fuels land demand. Investment Takeaway Juja Farm represents one of the strongest appreciation potentials in Kiambu County. Investors who purchase land early are likely to see value rise quickly due to continuous development and growing demand. 2. Ruiru – A Rapidly Growing Urban and Commercial Hub Ruiru has become a real estate powerhouse within the Nairobi Metropolitan area. It combines urban growth, industrial expansion, and huge demand from both residential buyers and commercial developers. Factors Driving Ruiru’s Price Growth • Proximity to Nairobi CBD Ruiru’s location along Thika Road and close to major industrial zones makes it ideal for people working in the city but looking for affordable land and housing. • Growth of universities and institutions The presence of major institutions—including Kenyatta University, Zetech University, and several TVET colleges—keeps demand for rental housing high, which drives long-term value appreciation. • Bypasses, highways, and upgraded road networks Improved transport networks such as the Eastern Bypass and proposed expansions continue to elevate Ruiru’s real estate demand. Infrastructure alone has lifted land prices at a rate exceeding income growth, especially in estates and upcoming gated communities. Investment Takeaway Ruiru is ideal for investors looking for land that will appreciate steadily while offering opportunities for residential development, rental units, or long-term speculation. 3. Kamulu, Joska & Malaa (Kangundo Road) – A Fast-Rising Affordable Investment Belt The Kangundo Road corridor is one of the fastest-growing low-to-mid-income investment zones in Nairobi’s outskirts. Kamulu, Joska, and Malaa have seen a noticeable increase in land sales and property development. Why Kangundo Road Areas Are Appreciating Quickly • Improved road infrastructure The Kangundo Road upgrade has made the area more accessible for people commuting to Nairobi, Eastlands, or Industrial Area. Better roads usually lead to faster land value appreciation. • Rapid residential growth New estates, upcoming gated communities, and increased construction activity have attracted investors and first-time homebuyers. • More affordable entry prices Compared to towns closer to Nairobi, Kangundo Road offers more affordable land while still experiencing strong development. This affordability attracts a high volume of buyers, which accelerates appreciation. Investment Takeaway These areas offer strong value for investors seeking affordable land with long-term growth potential, supported by ongoing construction and increased demand for settlement. 4. Kitengela – Consistent Long-Term Growth Driven by Urban Migration Kitengela is one of Kenya’s most stable and consistent performers in land value appreciation. Its growth is sustained by a combination of settlement demand, commercial expansion, and improved social amenities. Why Kitengela Continues to Outperform Income Growth • Strong demand for residential homes and rental properties Many people moving out of Nairobi settle in Kitengela due to its affordable housing options, modern estates, and growing economic activities. • Industrial and commercial expansion Industries, supermarkets, educational institutions, and hospitality businesses have created a thriving town with increased land demand. • Reliable infrastructure and utilities Electricity, water accessibility, tarmacked roads, and proximity to major highways make Kitengela extremely attractive for both local and diaspora investors. Investment Takeaway Kitengela remains a solid choice for long-term investors who want consistent appreciation supported by strong market fundamentals. 5. Nanyuki – High-Value Growth Driven by Tourism and Lifestyle Investments Nanyuki has become one of Kenya’s premier lifestyle and tourism-driven investment locations. Its land value increase is driven by unique factors that make it stand out from other towns. Why Nanyuki’s Land Prices Are Rising Rapidly • Tourism growth and hospitality development Nanyuki is a gateway to Mt. Kenya, conservancies, and wildlife attractions. Increased tourism leads to more lodges, Airbnbs, and high-end developments. • Diaspora investment and holiday homes More Kenyans abroad are investing in holiday homes or retirement houses in Nanyuki due to its favorable climate and peaceful environment. • High-end gated communities and residential projects Modern estates and planned developments attract buyers looking for secure and scenic living environments. Investment Takeaway Nanyuki presents strong appreciation potential for investors seeking lifestyle-oriented property, Airbnb opportunities, or long-term development. Why These Areas Beat Salary Growth Across Kenya 1. Infrastructure Leads Development When major roads are built or improved, land prices rise almost immediately. Commuter towns become attractive as transportation becomes easier. 2. Population Movement and Urban Expansion As Nairobi expands outward, nearby towns experience rapid demand for housing, services, and land. 3. Increased Demand for Affordable Land Most Kenyans search for land within affordable ranges—this spikes demand in the outskirts, causing appreciation. 4. Business and Industry Growth Areas attracting industries, schools, and businesses...

First Time Land Buyer in Kenya

Why Buying Land in Kenya Makes Perfect Sense Right Now First time land buyers in Kenya face an unprecedented opportunity in today’s property market. Land prices in strategic locations like Juja Farm and Ruiru East remain affordable while showing consistent 20-25% annual appreciation rates that outpace most investment alternatives. Kenya’s growing population and expanding middle class create sustained demand for residential properties, making land ownership a smart long-term wealth building strategy. First time land buyers who act now position themselves ahead of rising prices driven by infrastructure development and urban expansion around major cities. The government’s focus on affordable housing and infrastructure projects directly benefits first time land buyers through improved roads, utilities, and public services that increase property values over time. Young professionals and entrepreneurs particularly benefit from entering the property market early in their careers. Understanding Different Types of Land Ownership in Kenya Freehold vs Leasehold: What First Time Land Buyers Need to Know Freehold land ownership provides first time land buyers with permanent property rights that can be passed to future generations without time restrictions. Most residential plots in areas like Juja Farm offer freehold titles, giving buyers complete control over their investment. Leasehold properties typically offer 99-year terms and may have certain restrictions on use or development. First time land buyers should understand these limitations before committing, though leasehold properties often cost less initially and can still provide substantial investment returns. The choice between freehold and leasehold affects financing options, development plans, and long-term investment strategy. First time land buyers benefit from understanding both options to make informed decisions that align with their financial goals and family planning. Agricultural vs Residential Land Classifications Agricultural land often costs less per acre but may require conversion approvals before residential development. First time land buyers interested in agricultural properties should verify conversion possibilities and associated costs before purchasing. Residential zoned land permits immediate home construction without additional approvals, making it ideal for first time land buyers planning to build within a few years. These properties typically cost more but eliminate regulatory delays and conversion expenses. Mixed-use zoning allows both residential and commercial development, providing first time land buyers with flexibility for future income generation through rental properties or small businesses on their land. Step 1: Setting Your Land Buying Budget Calculating What First Time Land Buyers Can Actually Afford First time land buyers should allocate no more than 30% of their monthly income to land payments, including installment amounts, development savings, and related expenses. This conservative approach prevents financial strain while building wealth through property ownership. Beyond the purchase price, first time land buyers need funds for legal fees (typically 2-3% of property value), survey costs (KES 50,000-100,000), and development expenses like fencing, water connection, and soil testing that can add 20-30% to total investment. Emergency funds remain crucial for first time land buyers to handle unexpected expenses or income disruptions without jeopardizing their property investment. Financial advisors recommend maintaining six months of expenses in savings throughout the buying process. Down Payment Strategies for First Time Land Buyers Most flexible payment plans require 20-40% down payments, meaning first time land buyers need KES 130,000-260,000 for a KES 650,000 plot. Saving strategies like automatic transfers, side businesses, or family assistance help accumulate these amounts systematically. Some first time land buyers combine resources with family members or trusted friends to increase their purchasing power and access better properties. Joint ownership arrangements require clear legal agreements but can accelerate property acquisition. Asset liquidation, including selling vehicles, electronics, or other investments, provides down payment capital for first time land buyers transitioning toward real estate investment. This strategy requires careful planning but can provide substantial down payments. Step 2: Choosing the Right Location Why Juja Farm Appeals to First Time Land Buyers Juja Farm offers first time land buyers the perfect combination of affordability, accessibility, and growth potential that makes it ideal for building long-term wealth. Properties start around KES 650,000 for 50×100 plots with ready title deeds and basic infrastructure. The area’s proximity to Jomo Kenyatta University creates sustained rental demand that benefits first time land buyers planning investment properties. Student housing provides consistent income streams while properties appreciate in value over time. Infrastructure development including the Eastern Bypass and improved road networks directly benefits first time land buyers through increased property values and improved accessibility to Nairobi and other major centers. Ruiru East: Another Smart Choice for First Time Land Buyers Ruiru East provides first time land buyers with excellent connectivity to Nairobi via the Thika Superhighway while maintaining affordable property prices that appeal to middle-income investors seeking their first real estate investment. The area’s rapid commercial development creates employment opportunities that support property demand and rental markets. First time land buyers benefit from this economic growth through property appreciation and rental income potential. Planned infrastructure improvements including expanded water systems and road networks will directly benefit first time land buyers through increased property values and improved quality of life for residents. Browse our beginner-friendly properties perfect for first time land buyers Step 3: The Land Search Process Where First Time Land Buyers Should Start Looking Online property platforms provide first time land buyers with convenient access to available properties, pricing information, and basic details about different areas. However, online research should be supplemented with physical site visits and professional verification. Reputable real estate companies specializing in areas like Juja Farm offer first time land buyers professional guidance, verified properties, and support throughout the buying process. These companies typically maintain relationships with qualified lawyers and surveyors. Word-of-mouth recommendations from successful property owners provide first time land buyers with valuable insights about reliable companies, good locations, and potential problems to avoid during their property search. What to Look for During Site Visits Access roads significantly impact property value and development costs. First time land buyers should verify that properties have reliable road access during both dry and rainy seasons, as poor access can limit development options and resale value. Utility availability including...

Flexible Payment Plans for Land Purchase in Kenya: Making Property Investment Accessible

Understanding Modern Land Payment Structures: Flexible Payment Plans in Kenya Kenya’s property market has evolved significantly to accommodate diverse financial situations and investment strategies. Traditional cash-only requirements that previously limited property ownership to wealthy individuals have given way to flexible payment arrangements that enable middle-income earners and young professionals to build wealth through real estate investment. Modern payment structures recognize that property buyers have varying income patterns, cash flow constraints, and financial planning needs. These arrangements have democratized property ownership while maintaining security for both buyers and sellers through structured legal agreements and documented Flexible Payment Plans in Kenya The shift toward flexible payments has particularly benefited areas like Juja Farm and Ruiru East, where affordable plot prices combined with manageable payment terms create opportunities for first-time property investors. This accessibility has contributed to rapid development in these regions while providing buyers with realistic pathways to property ownership. View our current payment plan options for available properties Cash Payment Benefits and Strategic Advantages Immediate Ownership and Discount Opportunities: Flexible Payment Plans in Kenya Cash purchases provide buyers with immediate property ownership and often include significant price reductions that can range from 5% to 15% depending on property value and market conditions. These discounts effectively increase investment returns by reducing the total acquisition cost while eliminating interest or financing charges. Cash buyers typically receive priority consideration when multiple offers exist for desirable properties. Sellers prefer cash transactions because they eliminate financing uncertainties and enable faster completion of sale processes. This preference often translates into better negotiating positions for cash buyers. The absence of monthly payment obligations allows cash buyers to focus entirely on property development, rental income generation, or long-term appreciation without ongoing financial commitments to the original purchase. This freedom provides flexibility for future investment decisions and financial planning. Documentation and Legal Simplicity Cash transactions involve simpler documentation requirements and faster title transfer processes compared to installment arrangements. The straightforward nature of cash purchases reduces legal complexities and potential disputes while ensuring clear ownership transfer. Legal costs for cash purchases are typically lower because they involve fewer documents and less complex agreements. The reduced legal overhead makes cash purchases more cost-effective overall, particularly for smaller property transactions. Cash payments eliminate the need for payment monitoring and collection systems that installment plans require. This simplicity reduces administrative burdens for both buyers and sellers while minimizing potential disputes over payment schedules or terms. Installment Payment Systems and Structures Monthly Payment Arrangements Monthly installment plans typically range from 6 to 24 months, with most buyers choosing 12-month arrangements that balance affordability with reasonable completion timelines. These plans usually require down payments of 20% to 40% of the total property value, with remaining balances divided into equal monthly payments. Interest charges on installment plans vary but typically range from 0% to 8% annually, depending on payment period length and buyer creditworthiness. Some companies offer interest-free arrangements for shorter payment periods, while longer terms may include modest interest charges to compensate for extended payment risks. Payment schedules can often be customized to match buyer income patterns, with some arrangements allowing larger payments during certain months or seasonal adjustments for buyers with irregular income sources. This flexibility makes property investment accessible to entrepreneurs, farmers, and others with variable income patterns. Quarterly and Semi-Annual Options Longer payment intervals like quarterly or semi-annual arrangements suit buyers with irregular income or those who receive periodic bonuses, commissions, or seasonal earnings. These arrangements typically require larger down payments but offer more flexibility in payment timing. Professional buyers who receive annual bonuses or periodic large payments often prefer these arrangements because they align with their cash flow patterns. The reduced frequency of payments simplifies financial planning while maintaining manageable payment amounts. Some buyers combine regular employment income with business profits or agricultural earnings that arrive seasonally. Flexible payment schedules accommodate these income patterns while enabling property investment that might otherwise be impossible with rigid monthly requirements. Down Payment Strategies and Options Minimum Down Payment Requirements Most flexible payment arrangements require down payments ranging from 20% to 50% of total property value, with 30% representing the most common requirement. These down payments demonstrate buyer commitment while providing sellers with immediate partial payment and reduced collection risks. Down payment amounts often correlate with payment period length, with longer installment periods typically requiring higher initial payments. This structure protects sellers against payment defaults while ensuring buyers maintain significant financial stakes in their property investments. Some companies offer graduated down payment options where buyers can increase their initial payments in exchange for better interest rates or shorter payment periods. These arrangements provide buyers with choices that match their financial capabilities and investment strategies. Alternative Down Payment Sources Family assistance represents a common source of down payment funds, with many buyers combining personal savings with family support to achieve required down payment levels. This approach often enables younger buyers to enter the property market earlier than would otherwise be possible. Business profits, savings from employment, or proceeds from other investments frequently provide down payment capital. Some buyers strategically time property purchases to coincide with business success periods or investment liquidation to maximize their down payment capabilities. Asset liquidation, including selling vehicles, stocks, or other property, provides down payment funds for buyers transitioning between different investment types. This strategy requires careful planning but can enable property investment with superior long-term appreciation potential. Legal Framework and Contract Protection Payment Agreement Documentation Comprehensive payment agreements specify exact payment amounts, due dates, interest charges if applicable, and consequences for payment delays or defaults. These agreements protect both buyers and sellers by establishing clear expectations and legal remedies for various scenarios. Legal documentation should include property descriptions, title deed transfer procedures, and conditions under which buyers gain full ownership rights. Proper documentation ensures that buyers receive legal protection throughout the payment period while sellers maintain security until final payments are completed. Professional legal review of payment agreements provides essential protection for buyers, particularly those unfamiliar with property law or contract...

Juja Farm Property Investment: Market Analysis and Growth Projections for 2024-2025

Current Market Position and Investment Landscape Juja Farm has emerged as one of Kenya’s most compelling property investment destinations, driven by strategic location advantages and accelerating infrastructure development. Located 33 kilometers from Nairobi’s central business district along the Thika Superhighway, this area offers investors the perfect balance of accessibility and affordability that characterizes successful real estate markets. View our available Juja Farm properties with verified title deeds Property prices in Juja Farm have demonstrated consistent upward momentum, with land values appreciating between 18-25% annually over the past three years. This growth rate significantly outpaces inflation and provides investors with substantial returns on their capital investments. The trend shows no signs of slowing, particularly as major infrastructure projects continue to enhance the area’s connectivity and commercial viability. The investment landscape encompasses various property types, from residential plots suitable for individual homebuilders to larger parcels ideal for commercial development. Most properties in prime locations like Juja Mastores, Baraka Gardens, and Juja Meadows range from KES 650,000 to KES 1.8 million for standard 50×100 foot plots, making them accessible to middle-income investors while maintaining strong appreciation potential. Infrastructure Development Impact on Property Values Transportation Network Enhancements The Thika Superhighway represents the cornerstone of Juja Farm’s infrastructure advantages, providing direct connection to Nairobi in approximately 45 minutes during normal traffic conditions. This highway has transformed commuting patterns and made Juja Farm viable for professionals working in Nairobi while seeking affordable housing options. The proposed Greater Eastern Bypass will further enhance connectivity, creating alternative routes that reduce traffic congestion and improve access to other parts of Kenya. Properties positioned near this upcoming infrastructure project have already begun showing premium pricing, with some areas experiencing 30% price increases in anticipation of completion. Local road networks within Juja Farm continue expanding, with county government investments in tarmac roads reaching previously remote areas. These road improvements directly impact property values, with plots gaining road access typically appreciating 15-20% within six months of completion. Utility Infrastructure and Services Reliable electricity supply from Kenya Power reaches most developed areas within Juja Farm, with ongoing expansion projects bringing power to previously underserved locations. Properties with existing electricity connections command premium prices and attract serious buyers more quickly than those requiring new connections. Water infrastructure has improved significantly, with multiple sources including county water systems and private boreholes ensuring reliable supply. The Kiambu County government continues investing in water distribution networks, expanding coverage to new residential areas and supporting commercial development. Internet connectivity has reached near-universal coverage through multiple providers, supporting the growing number of professionals working remotely from Juja Farm. This connectivity advantage makes the area attractive to younger buyers and tech-savvy investors who require reliable internet access. Educational Institutions and Their Market Influence Jomo Kenyatta University of Agriculture and Technology JKUAT’s presence creates sustained demand for student housing, rental properties, and commercial services throughout Juja Farm. The university’s continued growth and expansion programs ensure long-term demand stability that benefits property investors. Student housing represents a particularly lucrative investment opportunity, with rental yields reaching 12-15% annually for well-located properties. The consistent academic calendar provides predictable rental income streams that many investors find attractive compared to other property types. Faculty and staff housing needs also drive demand for quality residential properties, with university employees often seeking permanent homes near their workplace. This demographic typically represents stable, long-term tenants or buyers with steady income sources. Primary and Secondary Schools The area hosts numerous quality educational institutions serving local families and attracting residents from surrounding areas. Schools like Juja Farm Primary and various private institutions create additional demand for family housing and support commercial activities. Educational infrastructure improvements continue attracting young families to the area, driving demand for larger residential plots suitable for family homes. This demographic shift toward family-oriented development supports long-term property value appreciation and community stability. Commercial Development and Economic Growth Shopping Centers and Retail Infrastructure Juja Farm Town serves as the commercial hub for the broader area, offering banking services, supermarkets, and various retail establishments that support daily life for residents. The town continues expanding, with new commercial developments adding employment opportunities and attracting additional residents. Smaller shopping centers and commercial plots throughout Juja Farm provide investment opportunities for commercial property development. These areas often show higher returns than residential properties but require larger initial investments and more sophisticated management approaches. Local markets and informal commercial activities create vibrant economic ecosystems that support property demand. Areas near markets typically experience steady property appreciation as commercial activities increase foot traffic and support local businesses. Employment Opportunities and Economic Diversification Manufacturing and light industrial activities have begun establishing operations in and around Juja Farm, creating local employment opportunities that reduce dependence on Nairobi-based jobs. This economic diversification strengthens the local property market by providing income sources for residents. Small business development thrives throughout the area, with entrepreneurs establishing services ranging from construction companies to agricultural processing operations. This business growth creates demand for both commercial and residential properties while strengthening the local economy. Demographic Trends and Market Demand Target Buyer Profiles Young professionals represent the largest buyer demographic, typically seeking their first property investments or primary residences outside Nairobi’s expensive housing market. This group often prioritizes affordability, connectivity, and growth potential over immediate amenities or established neighborhoods. Investors from the Kenyan diaspora increasingly view Juja Farm as an attractive option for building wealth through property investment. These buyers often purchase multiple properties for rental income or long-term appreciation, providing market stability and driving continued demand. Local residents upgrading from smaller properties or rental housing contribute steady demand for mid-range properties. This demographic understands the area well and often makes informed investment decisions based on long-term growth potential rather than short-term trends. Population Growth and Housing Demand Population growth in Juja Farm has accelerated significantly, with census data showing increases of 8-12% annually in developed areas. This growth rate substantially exceeds national averages and indicates strong economic fundamentals driving continued migration to the area. Housing supply has struggled to keep pace with...

Title Deed Verification in Kenya: Your Complete Protection Against Land Fraud

Understanding Kenya’s Land Ownership Documentation: Title Deed Verification in Kenya Title deeds represent the cornerstone of property ownership in Kenya. These legal documents establish irrefutable proof of land ownership and contain critical information including the registered owner’s name, exact parcel number, precise land measurements, and specific geographical location. Without this document, claiming legal ownership of any property becomes impossible under Kenyan law. The importance of proper title deed verification cannot be overstated in today’s property market. With land fraud cases increasing across Kenya, particularly in high-growth areas like Juja Farm, Ruiru East, and other developing regions around Nairobi, buyers must understand the verification process thoroughly before committing to any land purchase. The Legal Framework Behind Kenya’s Title Deed System Kenya’s land registration system operates under the Land Registration Act 2012, which established three main types of land ownership: public land, community land, and private land. Most individual property purchases involve private land, which requires proper documentation through registered title deeds. The system recognizes two primary types of title deeds: freehold and leasehold. Freehold titles grant permanent ownership rights, allowing owners to use, sell, or transfer the property without time restrictions. Leasehold titles, typically lasting 99 years, provide temporary ownership rights but still offer substantial security for property investment. Land Registration Act 2012 Current Legal Requirements for Valid Title Deeds Every legitimate title deed in Kenya must contain specific mandatory information. The document must display the registered owner’s full legal name, matching their national identification documents. It must include the precise parcel number, which serves as the property’s unique identifier within the national land registry system. The title deed must also specify the exact land size, typically measured in acres or square meters, along with detailed boundary descriptions. Geographic coordinates and survey plan references provide additional verification of the property’s precise location and boundaries. Step-by-Step Process of Title Deed Verification in Kenya Official Land Search Through Government Channels The most reliable method for verifying land ownership involves conducting an official land search through the Ministry of Lands and Physical Planning. This process can be completed either online through the eCitizen platform or by visiting physical government offices. To initiate an online search, property buyers need the specific parcel number and location details. The eCitizen platform requires users to create an account, pay the required fee of KES 500, and submit the search request. Processing typically takes 2-3 working days, after which buyers receive detailed ownership information. Physical office visits offer immediate verification but may involve longer waiting times. Buyers should bring proper identification and payment for the search fee. Government offices provide printed search reports that include comprehensive ownership history and any existing charges or restrictions on the property. Information Revealed Through Official Land Searches Official land searches provide extensive information about property ownership and legal status. The search report displays the current registered owner’s name, which must match exactly with the person or entity selling the property. Any discrepancies in names or identification details should raise immediate concerns. The report also reveals any existing charges, caveats, or legal restrictions on the property. Charges typically indicate outstanding loans or mortgages using the property as collateral. Caveats represent legal warnings about disputed ownership or pending court cases involving the property. Historical ownership information helps buyers understand how the property changed hands over time. Frequent ownership changes within short periods may indicate potential problems or disputes surrounding the land. Red Flags to Watch During Title Deed Verification in Kenya Document Authentication Concerns Fraudulent title deeds have become increasingly sophisticated, making careful examination essential. Genuine title deeds use specific paper quality, watermarks, and security features that counterfeit documents often lack. The government seal and official signatures must appear clear and properly positioned. Original title deeds should never show signs of alteration, erasure, or overwriting. Any corrections or changes must be officially endorsed by the relevant government department. Photocopied documents should never be accepted as proof of ownership during property transactions. Ownership Discrepancies and Warning Signs Multiple people claiming ownership of the same property represents a major red flag requiring immediate investigation. Buyers should verify that the seller’s identification documents match exactly with the names on the title deed. Alternative spellings or slight name variations often indicate fraudulent activity. Sellers who refuse to provide original title deeds or resist official verification processes should be approached with extreme caution. Legitimate property owners have no reason to avoid proper documentation procedures and typically welcome thorough verification as it protects all parties involved. Location and Boundary Issues Property boundaries described in title deeds must match the actual land being sold. Buyers should conduct physical site visits accompanied by qualified surveyors to verify that the land measurements and boundaries align with the documentation. Encroachment issues, where neighboring properties extend beyond their legal boundaries, create ongoing legal complications. Professional boundary surveys help identify these problems before completing the purchase transaction. The Role of Professional Services When to Engage Licensed Surveyors Professional surveyors provide essential services for property verification, particularly for larger land purchases or properties with complex boundaries. These experts can verify that the physical land matches the descriptions and measurements in the title deed. Surveyors also identify potential boundary disputes with neighboring properties and ensure that access roads and utilities align with the legal documentation. Their reports provide additional legal protection and help buyers make informed decisions about property purchases. Legal Representation and Due Diligence Qualified lawyers specializing in property law offer crucial protection during land purchases. They can interpret complex legal language in title deeds, identify potential legal issues, and ensure that all documentation meets current legal standards. Legal professionals also coordinate with government offices to verify information and handle the formal transfer processes. Their involvement significantly reduces the risk of legal complications after completing the property purchase. Technology and Modern Verification Methods Digital Land Registry Systems Kenya’s ongoing digitization of land records provides new opportunities for property verification. The digital registry system aims to reduce fraud and improve access to land ownership information while maintaining comprehensive...

Real Estate Investment Guide Kenya: Where to Start, What to Know & How to Succeed

Introduction to Real Estate Investment in Kenya Real estate investment in Kenya has evolved into one of the most lucrative and stable opportunities for both local and international investors. With a growing population, expanding urban centers, improved infrastructure, and increasing demand for residential and commercial spaces, Kenya offers an ideal environment for real estate growth. Whether you’re interested in buying land, developing rental properties, or investing in mixed-use developments, this guide offers comprehensive insights into real estate investment in Kenya. Why Invest in Kenya’s Real Estate Market ✅ Growing Urbanization & Infrastructure Major cities like Nairobi, Mombasa, Kisumu, and Nakuru are experiencing rapid growth. Developments such as the Nairobi Expressway, the Standard Gauge Railway (SGR), and new bypasses are increasing property values in their surrounding areas. ✅ High Return on Investment (ROI) Well-located properties, especially in satellite towns like Ruiru, Juja farm, and Thika, are delivering ROI between 12% and 20% annually depending on property use and management. ✅ Government Support & Incentives The government promotes affordable housing and public-private partnerships. There are also tax incentives for certain property developments and REITs (Real Estate Investment Trusts). Types of Real Estate Investments in Kenya Best Locations to Invest in Kenya Real Estate (2025 Edition) Location Investment Type Why It’s Hot Ruiru Land, Apartments Infrastructure, university population growth Syokimau Gated communities, plots Near SGR, JKIA, expressway Thika Commercial, residential Affordable land, upcoming developments Naivasha Airbnb, holiday homes Tourism hub, near geothermal sites Nairobi CBD Commercial offices Business center, foot traffic Kitengela Residential estates Middle-class demand, affordable land Mombasa Beachfront, Airbnb Tourist attraction, port access Legal Process of Buying Property in Kenya Foreigners Investing in Kenya Real Estate Key Factors to Consider Before Investing Taxes & Charges for Real Estate Investors in Kenya Charge/Tax Rate/Amount Stamp Duty 2% (rural) or 4% (urban) Rental Income Tax 10% monthly on gross rental income Capital Gains Tax 15% on property sale profits Land Rates Varies by county VAT on Commercial 16% if applicable Top Real Estate Investment Tips for Kenya Risks in Real Estate & How to Avoid Them Risk How to Mitigate Fake title deeds Conduct official land search & work with lawyers Fraudulent sellers Use verified agents and official transactions Zoning violations Confirm with county offices Delayed developments Choose reputable developers & projects Poor rental management Hire professional property managers Oversupply in saturated areas Do thorough market analysis before purchase Your Path to Real Estate Wealth in Kenya Real estate investment in Kenya remains a powerful strategy for wealth creation and financial freedom. From buying plots in fast-developing towns to investing in rental units in urban centers, opportunities abound for all types of investors. As the property market continues to grow in value and scope, staying informed, working with professionals, and making strategic decisions are the keys to success. Whether you’re a first-time investor or an experienced property owner, Kenya’s real estate sector provides a robust platform for sustainable growth. Take the time to research, plan wisely, and secure your share of Kenya’s booming property market.

Buying Land in Kenya: Complete Checklist for Smart Investors

Why You Need a Land Buying Checklist in Kenya Buying land in Kenya is a powerful way to build wealth, but it’s also a process filled with legal and financial procedures that can be overwhelming—especially for first-time buyers. Whether you’re buying land for residential development, farming, speculation, or commercial use, having a clear step-by-step checklist ensures you avoid costly mistakes and fraud. This blog provides the ultimate land buying checklist in Kenya, designed to help you make informed, secure, and legal property purchases. ✅ Step-by-Step Checklist for Buying Land in Kenya 1. Identify the Purpose of the Land Before you even start your search: 🔍 Pro Tip: Ensure the land is properly zoned for your intended use by checking with the local county government. 2. Budget for Land and Associated Costs Don’t just budget for the land price—include: 3. Search for Genuine Land Listings 4. Conduct a Land Search at the Ministry of Lands ✅ What to Check: 📝 How to do a land search:Visit the land registry or use eCitizen, pay Ksh 500, and get the official search results within 2–3 days. 5. Confirm Land Boundaries with a Surveyor 📍 Why it matters: Prevents future disputes with neighbors or double allocations 6. Get Land Maps from Survey Department Buy the mutation map and area map from the local Survey of Kenya office. These documents show: Cost: Ksh 300–500 per map 7. Verify Land Use & Zoning Regulations Visit the County Physical Planning office to confirm: 8. Meet the Seller and Confirm Identity 9. Draft a Sale Agreement Prepared by an advocate, the sale agreement should include: 💼 You’ll usually pay 10% deposit upon signing the agreement. 10. Obtain Land Control Board (LCB) Consent Required for: ✅ LCB meetings are held monthly. Apply and attend in person. Fee: Ksh 1,000 11. Complete the Transfer Process Documents needed: 12. Title Deed Transfer and Registration After approval and verification: ✅ Ensure you collect the original title deed, payment receipts, and transfer documents. 📂 Documents Checklist: What You Need Document Purpose National ID & KRA PIN Identity verification Copy of title deed Verify ownership & parcel number Land search certificate Confirm land status Mutation & area maps Confirm boundaries & location Sale agreement Legal transaction record Transfer forms & consent forms Ownership change Valuation report Stamp duty calculation LCB consent (if applicable) Approval for agricultural land Receipts for payments made Proof of transaction 🔐 Tips to Avoid Land Buying Scams in Kenya 🛑 Red Flags to Watch Out For 🏁 Final Checklist Before Payment ✅ Original title deed is available✅ Land search shows clean ownership✅ Maps and survey confirmed dimensions✅ Sale agreement signed by both parties✅ Payment made through traceable methods✅ All necessary consents and approvals obtained✅ Lawyer confirms registration process has started Secure Your Investment With Due Diligence Buying land in Kenya can be one of the best financial decisions you’ll ever make—but only if done correctly. Always follow due process, work with professionals, and verify every document before you commit. With the checklist above, you’re equipped to navigate the Kenyan land buying process with confidence, legality, and security. Whether you’re buying land for development, speculation, or long-term investment, this guide helps ensure your investment is protected, profitable, and future-ready.