Kenya’s land market has changed rapidly in the past decade. While salaries for most Kenyans have barely grown, land values in some regions are increasing at rates that far exceed income growth. This shift has created a powerful opportunity for investors who want to secure appreciating assets that can outperform inflation, employment income, and traditional savings methods.

Understanding where land prices are rising the fastest helps investors position themselves early. These fast-growing regions often share common characteristics—major infrastructure upgrades, increased population movement, new commercial and industrial activity, and strong demand from buyers looking for affordable but promising alternatives to Nairobi’s high prices.

Below is a detailed breakdown of the areas currently experiencing the fastest land appreciation in Kenya and why they are outperforming salary growth.

1. Juja Farm – High-Growth Investment Area Fuelled by Infrastructure Development

Juja Farm has transitioned from a quiet peri-urban location into one of Kenya’s fastest-growing investment corridors. The region’s rapid land value increase is driven by several key forces:

Why Juja Farm Is Growing Faster Than Salaries

• Massive ongoing infrastructure upgrades

Road construction and improvements have significantly increased accessibility. The connection to Thika Road, together with the ongoing tarmacking within Juja Farm, has lowered commute times and made the area attractive for both settlement and speculation.

• Rising demand from Nairobi and Kiambu residents

Nairobi’s expansion has pushed homebuyers and investors into more affordable satellite towns. Juja Farm offers lower entry costs while still providing proximity to major towns.

• Increasing commercial activity

New shops, hardware stores, educational institutions, medical facilities, and residential developments have created an economic ecosystem that fuels land demand.

Investment Takeaway

Juja Farm represents one of the strongest appreciation potentials in Kiambu County. Investors who purchase land early are likely to see value rise quickly due to continuous development and growing demand.

2. Ruiru – A Rapidly Growing Urban and Commercial Hub

Ruiru has become a real estate powerhouse within the Nairobi Metropolitan area. It combines urban growth, industrial expansion, and huge demand from both residential buyers and commercial developers.

Factors Driving Ruiru’s Price Growth

• Proximity to Nairobi CBD

Ruiru’s location along Thika Road and close to major industrial zones makes it ideal for people working in the city but looking for affordable land and housing.

• Growth of universities and institutions

The presence of major institutions—including Kenyatta University, Zetech University, and several TVET colleges—keeps demand for rental housing high, which drives long-term value appreciation.

• Bypasses, highways, and upgraded road networks

Improved transport networks such as the Eastern Bypass and proposed expansions continue to elevate Ruiru’s real estate demand. Infrastructure alone has lifted land prices at a rate exceeding income growth, especially in estates and upcoming gated communities.

Investment Takeaway

Ruiru is ideal for investors looking for land that will appreciate steadily while offering opportunities for residential development, rental units, or long-term speculation.

3. Kamulu, Joska & Malaa (Kangundo Road) – A Fast-Rising Affordable Investment Belt

The Kangundo Road corridor is one of the fastest-growing low-to-mid-income investment zones in Nairobi’s outskirts. Kamulu, Joska, and Malaa have seen a noticeable increase in land sales and property development.

Why Kangundo Road Areas Are Appreciating Quickly

• Improved road infrastructure

The Kangundo Road upgrade has made the area more accessible for people commuting to Nairobi, Eastlands, or Industrial Area. Better roads usually lead to faster land value appreciation.

• Rapid residential growth

New estates, upcoming gated communities, and increased construction activity have attracted investors and first-time homebuyers.

• More affordable entry prices

Compared to towns closer to Nairobi, Kangundo Road offers more affordable land while still experiencing strong development. This affordability attracts a high volume of buyers, which accelerates appreciation.

Investment Takeaway

These areas offer strong value for investors seeking affordable land with long-term growth potential, supported by ongoing construction and increased demand for settlement.

4. Kitengela – Consistent Long-Term Growth Driven by Urban Migration

Kitengela is one of Kenya’s most stable and consistent performers in land value appreciation. Its growth is sustained by a combination of settlement demand, commercial expansion, and improved social amenities.

Why Kitengela Continues to Outperform Income Growth

• Strong demand for residential homes and rental properties

Many people moving out of Nairobi settle in Kitengela due to its affordable housing options, modern estates, and growing economic activities.

• Industrial and commercial expansion

Industries, supermarkets, educational institutions, and hospitality businesses have created a thriving town with increased land demand.

• Reliable infrastructure and utilities

Electricity, water accessibility, tarmacked roads, and proximity to major highways make Kitengela extremely attractive for both local and diaspora investors.

Investment Takeaway

Kitengela remains a solid choice for long-term investors who want consistent appreciation supported by strong market fundamentals.

5. Nanyuki – High-Value Growth Driven by Tourism and Lifestyle Investments

Nanyuki has become one of Kenya’s premier lifestyle and tourism-driven investment locations. Its land value increase is driven by unique factors that make it stand out from other towns.

Why Nanyuki’s Land Prices Are Rising Rapidly

• Tourism growth and hospitality development

Nanyuki is a gateway to Mt. Kenya, conservancies, and wildlife attractions. Increased tourism leads to more lodges, Airbnbs, and high-end developments.

• Diaspora investment and holiday homes

More Kenyans abroad are investing in holiday homes or retirement houses in Nanyuki due to its favorable climate and peaceful environment.

• High-end gated communities and residential projects

Modern estates and planned developments attract buyers looking for secure and scenic living environments.

Investment Takeaway

Nanyuki presents strong appreciation potential for investors seeking lifestyle-oriented property, Airbnb opportunities, or long-term development.

Why These Areas Beat Salary Growth Across Kenya

1. Infrastructure Leads Development

When major roads are built or improved, land prices rise almost immediately. Commuter towns become attractive as transportation becomes easier.

2. Population Movement and Urban Expansion

As Nairobi expands outward, nearby towns experience rapid demand for housing, services, and land.

3. Increased Demand for Affordable Land

Most Kenyans search for land within affordable ranges—this spikes demand in the outskirts, causing appreciation.

4. Business and Industry Growth

Areas attracting industries, schools, and businesses automatically experience higher demand for land.

5. Investor Confidence and Market Trends

More investors view land as a stable investment, which increases buying activity and pushes prices upward.

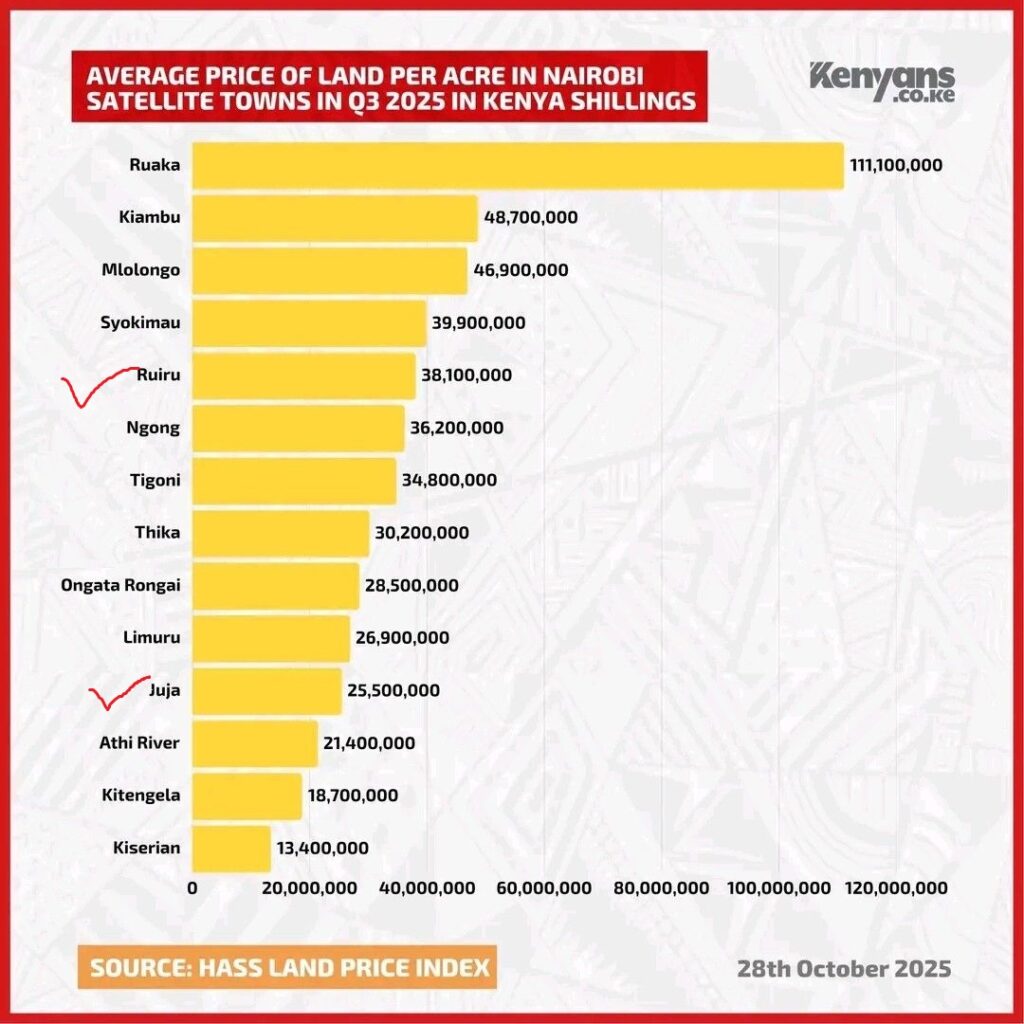

Average Price of Land Per Acre in Nairobi

Land prices in Nairobi and its surrounding metropolitan regions have reached levels that clearly show how fast the property market is evolving. The appreciation rate in some towns is now so high that it outpaces salary growth by an enormous margin. According to recent land price trends, areas like Ruiru and Juja have experienced exceptional increases, reflecting strong demand, rapid development, and strategic economic positioning.

Ruiru’s land price—averaging 38 million per acre—is now behaving like that cousin who went to Dubai once and came back with an accent.

It’s no longer the simple, quiet Ruiru people remember. This is the upgraded version: “Ruuirú”, confident, in demand, and very aware of its new status.

On the other hand, Juja, averaging 25.5 million per acre, has become the humble genius of Kiambu’s property market. Silent but powerful. Consistent but aggressive. Investors who saw Juja when it was going for KSh 600,000 per acre and ignored it because they were too busy living soft life now understand how fast growth can sneak up on a town.

At this rate, even land seems to be developing character. If buyers keep waiting, an acre may soon come with its own bodyguard and attitude.

Despite the humor, these numbers reflect a serious trend: land prices in key Nairobi satellite towns are rising at a pace that far exceeds income growth, making early investment the smartest strategy for long-term value.

Smart Tips for Investors Watching These Hot Zones

- Buy land close to major roads or upcoming infrastructure

- Choose areas showing active construction or new developments

- Confirm availability of water, electricity, and social amenities

- Work with trusted and reputable real estate companies

- Prioritize regions with documented appreciation history

- Verify ownership documents to avoid fraudulent sellers

Key Takeaways for Land Investors in Kenya

Land remains one of the strongest investment vehicles in Kenya, especially in areas where prices are rising faster than average income growth. Locations like Juja Farm, Ruiru, Kamulu, Kitengela, and Nanyuki stand out because they combine infrastructure improvements, growing population demand, commercial activity, and affordability.

Investors who identify these fast-appreciating regions early enjoy higher returns, long-term security, and opportunities for development or resale at profit.